The Simple Way to Stay Compliant in 2026 Without Losing Your Mind

A business owner once told us, “I don’t think we’re non-compliant… but I also wouldn’t bet money on it.”

That’s the most honest compliance statement we’ve heard all year.

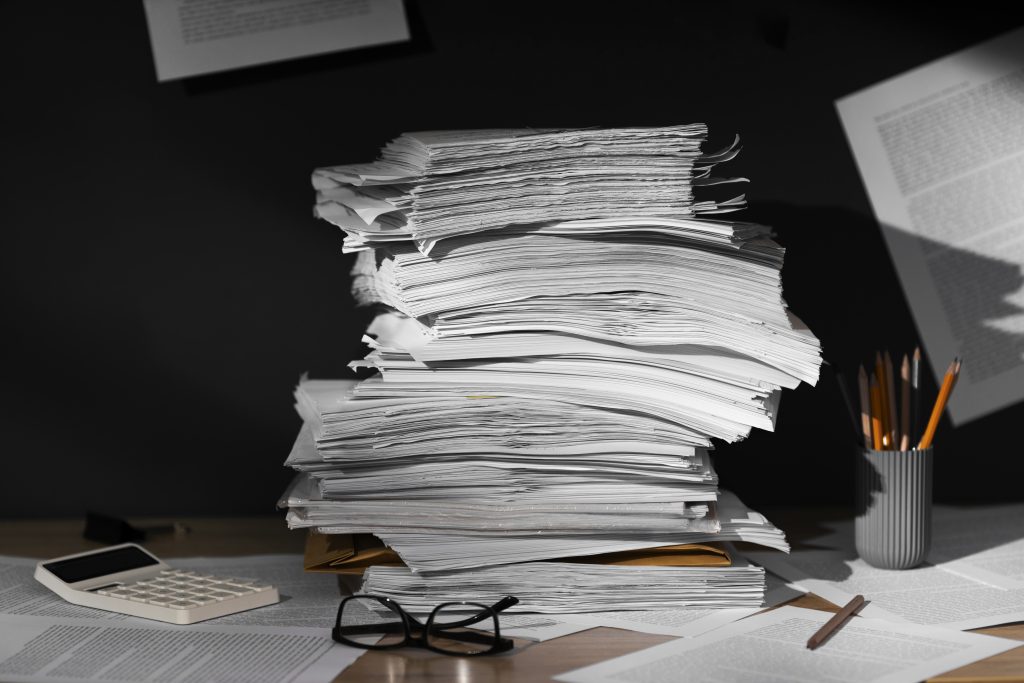

Nothing had gone wrong. No breaches. No scary letters. No angry clients. However, when a larger customer asked for documentation — policies, controls, vendor reviews — the room got quiet.

Everyone assumed someone else had it handled. Someone probably did. Somewhere.

That’s how compliance stress usually starts. Compliance rarely explodes. It just quietly collects dust.

Compliance in 2026: It’s Not Just About Regulations

In the past, compliance felt like something only certain industries dealt with.

Healthcare. Finance. Enterprise tech.

Now every growing company touches data. Every growing company uses cloud tools. Every growing company relies on vendors.

This means compliance isn’t a “big company” problem anymore.

It shows up quietly:

- Security questionnaires from prospects

- Insurance requirements

- Vendor risk forms

- Data privacy questions

- Contract language about controls

No single request feels overwhelming. But together? They create friction, and friction slows growth.

Complexity Isn’t the Real Issue; Timing Is

Most compliance problems aren’t caused by negligence. They’re caused by postponement. Policies will be written “soon.” Documentation gets cleaned up “next quarter.” Vendor reviews happen “when we have breathing room.”

And breathing room never comes.

So, compliance turns into a reactive exercise. Someone sends a 70-question spreadsheet. The team scrambles. IT digs through settings. Leadership searches inboxes.Operations try to remember who approved what. No one enjoys this.

Not because compliance is impossible, but because it wasn’t structured.

The Truth: Compliance Is Boring (and That’s a Good Thing)

The companies that handle compliance well don’t talk about it much, because it’s not dramatic. It’s scheduled. It’s documented. It’s assigned. It runs quietly in the background. That’s the goal.

If compliance feels intense, chaotic, or mysterious, it’s not a knowledge problem. It’s a systems problem, and any system can be fixed.

The Simple Way to Stay Compliant

The shift is simple. Stop treating compliance like a milestone. Start treating it like maintenance. You don’t “finish” compliance any more than you finish accounting. You maintain it. When that mindset changes, everything else gets easier.

Let’s break down what that looks like.

1. Pick an Owner (Yes, One Person)

In many organizations, compliance lives in the land of “shared responsibility.” This often means that no one truly owns it. That’s why it’s important to assign one accountable person. Not necessarily to do everything, but to track, coordinate, and maintain visibility.

Team members need to know that they are responsible for asking key questions:

- “Was that documented?”

- “Did we review that vendor?”

- “Who approved this access?”

This ensures that important things stop slipping. Clarity reduces anxiety immediately.

2. Build a Single Source of Truth. One of the fastest ways to create stress is to scatter documentation. Policies are kept in a shared drive. Vendor contracts are stored in email. Security settings are protected by someone’s memory.

Centralization doesn’t have to be complex. It just needs to exist. A defined structure is necessary for all policies, access controls, vendor lists, risk assessments, and review dates. When everything lives in one place, compliance stops feeling abstract. It becomes visible. And visible things are manageable.

3. Shrink the Review Cycle. Annual reviews feel productive until month eleven.

By then:

- New tools have been added.

- New employees were onboarded.

- Old vendors are no longer on the radar.

- Access permissions have changed.

Quarterly check-ins are shorter and calmer. During these milestones, ask:

- What has changed?

- Did we document it?

- Are permissions still correct?

- Are vendors still aligned?

Four small conversations beat one stressful overhaul.

4. Focus on Real Risk, Not Theoretical Fear. Not every business needs every control. Compliance gets overwhelming when teams try to solve every possible scenario at once. Instead, ask:

- What data would truly hurt us if it were exposed?

- Where does that critical data live?

- Who touches it?

- What are clients most likely to ask about?

Prioritize there. Structure around real exposure, not hypothetical disasters. That keeps your compliance practical.

5. Don’t Ignore Vendor Risk. In 2026, your data doesn’t just live with you.

It lives with:

- Your CRM provider.

- Your cloud platform.

- Your marketing tools.

- Your payroll system.

- Your file-sharing software.

When someone asks, “How do you evaluate your vendors?” the answer shouldn’t be, “We trust them.” That trust still needs documentation. A simple review checklist used consistently goes a long way. It’s not about suspicion. It’s about maturity.

Why This Protects Your Sanity

Things change when compliance becomes operational instead of reactive. Client questionnaires take hours, not days. Insurance conversations feel prepared, not pressured. Leadership answers questions confidently. Growth opportunities don’t stall. Teams aren’t scrambling. Compliance stops interrupting your week. It becomes background noise. And that’s where it belongs.

The Quiet Cost of Doing Nothing

You may not get fined. You may not face a breach.

But slow friction adds up. Deals take longer. Sales cycles get heavier. Internal time gets wasted. Stress increases quietly. Eventually, that friction becomes a ceiling, and ceilings are harder to fix than systems.

“We’re Still Small”

That’s exactly why this is easier now. It’s about fewer tools, fewer vendors, and fewer layers. Structure is simpler when the organization is smaller. Waiting until you’re larger doesn’t reduce complexity. It multiplies it.

Where a Technology Partner Fits In

At a certain point, compliance crosses into technical territory. This could include:

- Cloud configurations

- Access management

- Monitoring systems

- Backup validation

- Security frameworks

- Audit preparation

A compliance solutions partner becomes invaluable. Not to overwhelm you with jargon, but to design systems that:

- Align with how you operate.

- Reduce manual oversight.

- Provide visibility into risk.

- Keep documentation current.

The right partner doesn’t create more complexity. It removes uncertainty, and uncertainty is what makes people lose sleep.

A Simple Reset for 2026

If compliance feels unclear right now, start with a 4-week plan.

- Week 1: Name the owner, and map your documentation.

- Week 2: Centralize everything into one structured location.

- Week 3: Review your highest-risk systems and vendor list.

- Week 4: Schedule quarterly reviews for the rest of the year.

That’s it. It’s not complicated. No dramatic overhaul. No panic-driven transformation. Just a structure that keeps things working together.

Final Thoughts

Compliance should feel uneventful. If it feels chaotic, urgent, or mysterious, that’s a sign. Not that you’ve failed, but that you need better systems.

In 2026, the businesses that stay calm won’t be the ones with the most complex frameworks. They’ll be the ones who build compliance into how they work — early, simply, and consistently.

That’s the simplest way to stay compliant.

And keep your mind intact.

If compliance feels unclear in your organization, it might not require more effort, just better structure. If you’d like a clear view of where you stand, our team at Klik Solutions can help you assess, prioritize, and build a system that fits your business. Let’s start the conversation.

—–*—– —–*—– —–*—– —–*—– —–*—– —–*—

Frequently Asked Questions

How do I know if my business is compliant?

You know your business is compliant when your policies, documentation, and security practices are clearly defined, regularly reviewed, and easy to produce when requested.

If you’re unsure where documentation lives, who owns compliance, or how often controls are reviewed, that’s usually a sign your compliance management process needs structure.

Compliance isn’t just about avoiding fines. It’s about having visibility into your data, vendors, and risk exposure — and being able to confidently demonstrate that to clients, insurers, or partners.

How often should a company review its compliance policies?

For most growing businesses, compliance policies should be reviewed quarterly, not just annually.

Quarterly compliance reviews help you:

- Document new tools and vendors.

- Update access permissions.

- Adjust to regulatory changes.

- Align policies with how your business operates.

Small, consistent reviews prevent large, stressful overhauls later.

What is the easiest way to manage compliance for a small or mid-sized business?

The simplest way to manage compliance is to treat it like an ongoing system instead of a one-time project.

Start by:

- Assigning one accountable owner.

- Centralizing compliance documentation.

- Prioritizing high-risk data areas.

- Establishing a repeatable review process.

You don’t need an enterprise compliance department. You need clarity, ownership, and consistency.

Do small businesses really need a formal compliance process?

Yes — especially in 2026. Even small businesses handle customer data, rely on cloud platforms, and work with third-party vendors. That means clients, insurance providers, and partners increasingly expect documented compliance practices.

A formal compliance process doesn’t have to be complicated. It just needs to be intentional, documented, and repeatable. The earlier you build structure, the easier it scales.

How can I prepare for security questionnaires or compliance audits?

Preparation starts long before the questionnaire arrives. To prepare for security questionnaires or compliance audits:

- Keep policies and controls documented in one location

- Maintain an updated vendor risk list

- Review access permissions regularly

- Track changes to systems and tools

When compliance documentation is current and centralized, responding to questionnaires becomes routine instead of reactive.

BLOG

The latest articles

-

The Simple Way to Stay Compliant in 2026 Without Losing Your Mind

-

How to Get Tech Support That Feels Like a Real Partner, Not a Bot

-

Why “More Tools” Didn’t Improve Their Data — And What Actually Did

-

We Often See This Pattern Before a Cybersecurity Incident — Here’s Why It Happens

-

How to Make Tech Feel Less Overwhelming in 2026: A Guide for Busy Business Owners

-

Cloud, Compliance, and AI in 2026: The Real Risks Nobody Talks About

-

How to Future-Proof Your Infrastructure in 2026 Without Wasting Budget

Updated on February 20, 2026

Updated on February 20, 2026